In trading, expectancy is a key metric that helps traders understand the average amount of money they can expect to make (or lose) per trade over time. It provides insight into the overall profitability of a trading system or strategy.

Here’s the formula for calculating trading expectancy:

Expectancy=(Win Rate100×Average Win)−(Loss Rate100×Average Loss)\text{Expectancy} = \left( \frac{\text{Win Rate}}{100} \times \text{Average Win} \right) – \left( \frac{\text{Loss Rate}}{100} \times \text{Average Loss} \right)

Where:

- Win Rate is the percentage of trades that are winners.

- Loss Rate is the percentage of trades that are losers (equal to 100−Win Rate100 – \text{Win Rate}).

- Average Win is the average profit made from winning trades.

- Average Loss is the average loss from losing trades.

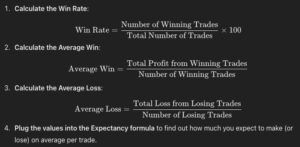

Steps to Calculate Expectancy:

- Calculate the Win Rate:Win Rate=Number of Winning TradesTotal Number of Trades×100\text{Win Rate} = \frac{\text{Number of Winning Trades}}{\text{Total Number of Trades}} \times 100

- Calculate the Average Win:Average Win=Total Profit from Winning TradesNumber of Winning Trades\text{Average Win} = \frac{\text{Total Profit from Winning Trades}}{\text{Number of Winning Trades}}

- Calculate the Average Loss:Average Loss=Total Loss from Losing TradesNumber of Losing Trades\text{Average Loss} = \frac{\text{Total Loss from Losing Trades}}{\text{Number of Losing Trades}}

- Plug the values into the Expectancy formula to find out how much you expect to make (or lose) on average per trade.

Example:

Let’s say you have the following data after a series of 100 trades:

- 60 winning trades and 40 losing trades.

- Total profit from winning trades = $6000.

- Total loss from losing trades = $4000.

- Win Rate = 60100×100=60%\frac{60}{100} \times 100 = 60\%

- Average Win = 600060=100\frac{6000}{60} = 100

- Average Loss = 400040=100\frac{4000}{40} = 100

- Expectancy = (60100×100)−(40100×100)=60−40=20( \frac{60}{100} \times 100 ) – ( \frac{40}{100} \times 100 ) = 60 – 40 = 20

So, the expectancy is $20, meaning on average, you expect to make $20 per trade.

This is a simplified view, but expectancy helps traders assess the long-term profitability of their strategies.

What could be considered a good expectancy ratio?

A good expectancy ratio in trading depends on your trading style and risk tolerance, but as a general guideline:

- Positive Expectancy: Any positive number is a good sign, as it means you expect to make money on average per trade.

For specific ratios, here are some benchmarks to consider:

General Expectancy Guidelines:

- Expectancy > 0.5: Excellent; you expect to make at least $0.50 for every $1 risked on average per trade.

- Expectancy between 0.2 and 0.5: Good; this indicates a consistently profitable strategy.

- Expectancy between 0 and 0.2: Marginally profitable; it could still be useful if other metrics (like risk management or win rate) are strong.

- Expectancy ≤ 0: Negative; this indicates you’re losing money on average, which suggests the strategy may need improvement.

Example of Expectancy in Relation to Risk/Reward:

- High Win Rate, Lower Risk/Reward Ratio: A strategy with a 70% win rate but smaller average wins (e.g., 1:1 risk/reward) can still have a solid expectancy if losses are kept small.

- Low Win Rate, High Risk/Reward Ratio: Even with a win rate as low as 30%, if the risk/reward ratio is high (e.g., 1:3), expectancy can still be good.

Key Points to Consider:

- Consistency: The strategy’s expectancy over a large number of trades should be positive. A few big wins could skew the expectancy temporarily, but consistent positive expectancy over time is the goal.

- Risk Management: Even a strategy with lower expectancy can be profitable if paired with effective risk management. For instance, keeping losing trades small and letting winning trades run.

Ultimately, a “good” expectancy is one that aligns with your overall risk tolerance, trading goals, and style. Traders often aim for expectancy ratios that reflect both profitability and a sustainable risk level over the long term.